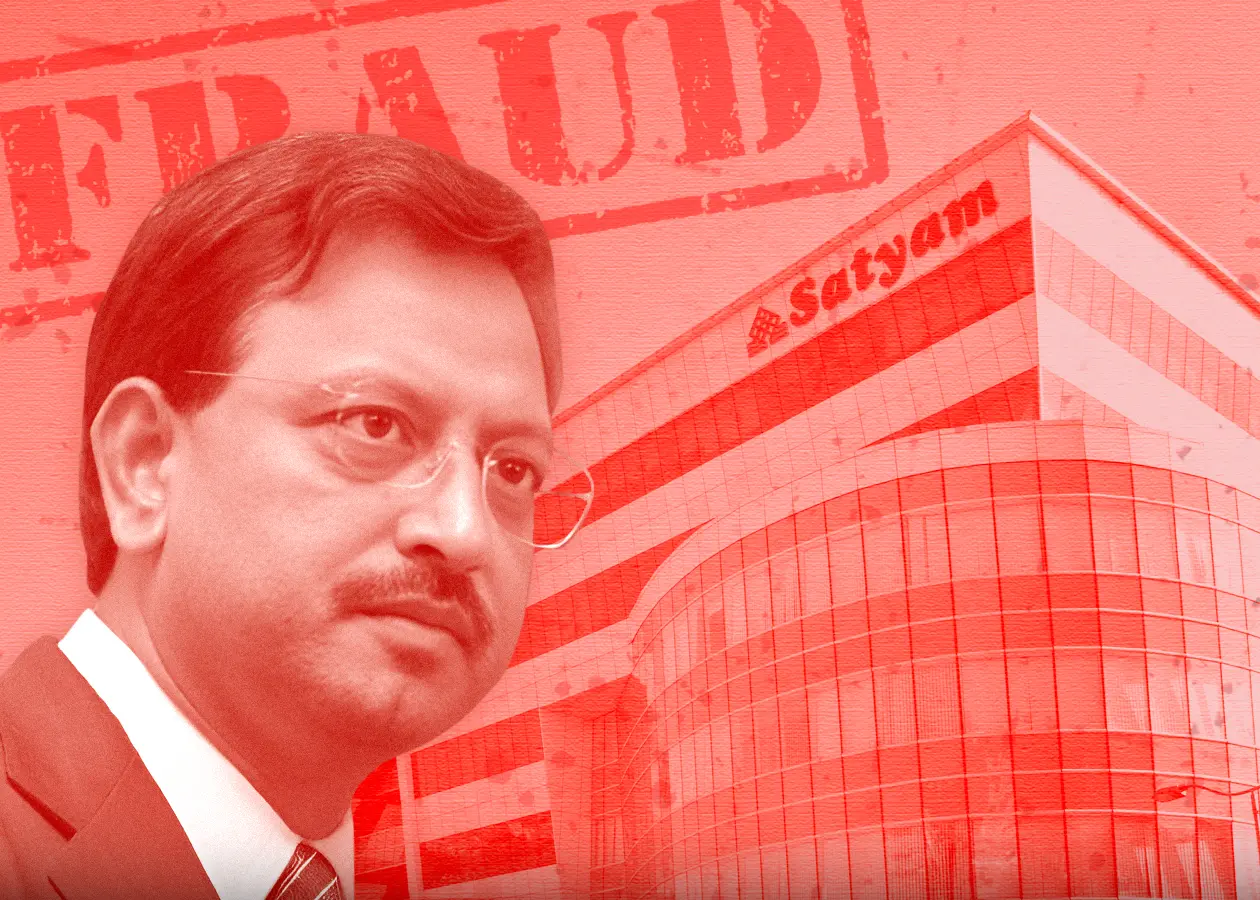

Satyam Computers Case: The ₹7,000 Crore Accounting Financial Fraud That Shook India’s IT Sector

Apr 1, 2025

The Collapse of Satyam Computers and its Aftermath

In the early 2000s, the Indian IT industry was riding a wave of unprecedented growth. Among the companies that epitomized this boom was Satyam Computer Services Ltd. Satyam Computers was a shining example of India’s IT success story, competing with giants like Infosys, Wipro, and TCS. With a global presence, thousands of employees, and a strong client base, the company was a favourite among investors and analysts. But beneath the surface, a massive financial fraud was brewing.

On January 7, 2009, the financial world was rocked when Satyam’s founder, Ramalinga Raju, admitted to orchestrating one of the biggest corporate frauds in Indian history. He confessed to inflating profits, manipulating financial statements, and creating a ₹7,000 crore accounting fraud that misled investors and regulators for years. The revelation sent shockwaves through the stock market—Satyam’s share price crashed by nearly 80% in a single day, wiping out thousands of crores in market value.

The scandal exposed serious gaps in corporate governance, internal audits, and regulatory oversight. But how did a company that once boasted billion-dollar revenues and a strong balance sheet deceive the market for so long? Let’s break down what happened at Satyam Computers and how the fraud unfolded.

About Satyam Computers

Satyam Computer Services Ltd. was founded in 1987 by Ramalinga Raju in Hyderabad, India. The company started as a small IT firm but quickly grew to become one of India's largest IT services providers. By the early 2000s, Satyam was a global player, offering software development, system maintenance, and consulting services to clients across the globe. Its clientele included Fortune 500 companies, and it was listed on both the Bombay Stock Exchange (BSE) and the New York Stock Exchange (NYSE).

The company capitalized on the outsourcing trend, leveraging India's skilled workforce and cost advantages. By 2008, Satyam employed over 53,000 professionals and operated in 67 countries, generating billions in revenue.

However, this success was largely built on fabricated financial statements. For years, the company manipulated earnings, showing inflated revenues and profits to attract more investments and maintain its stock price.

About the Fraud: How It Was Executed

Ramalinga Raju and his associates engaged in one of the most elaborate financial frauds in Indian corporate history. The key fraudulent practices included:

Inflated Revenues and Profits: Satyam overstated its revenues by falsifying invoices and inflating the number of clients. Fake bank statements were used to reflect higher cash reserves than the company held.

Fictitious Bank Balances: The company showed non-existent cash reserves amounting to ₹5,040 crore to mislead investors and regulators.

Manipulated Earnings Reports: By overstating earnings, Satyam’s stock price remained artificially high, allowing Raju and top executives to sell shares at inflated prices.

Lack of Transparency in Corporate Governance: Satyam’s board failed to detect these irregularities, highlighting weak internal controls and oversight mechanisms.

Financial Growth and Investor confidence before the fraud

Satyam Computers was perceived as one of India’s fastest-growing IT companies. Institutional investors, including marquee foreign funds, held significant stakes, viewing the company as a stable and high-growth IT player. At its peak, Satyam’s market capitalization crossed ₹12,000 crore, and its shares were actively traded on both the NSE and NYSE.

Satyam generated Rs. 25,415.4 million in total sales in 2003-04. By March 2008, the company's sales revenue had grown by over three times. The company demonstrated an annual compound growth rate of 38% over that period - (from 2003-08).

Financials (in Rs. Millions) | 2003-04 | 2004-05 | 2005-06 | 2006-07 | 2007-08 | Average Growth Rate (%) |

Net Sales | 25,415 | 34,642 | 46,343 | 62,284 | 81,372 | 38 |

Operating Profit | 7,743 | 9,717 | 15,714 | 17,107 | 20,857 | 28 |

Net Profit | 5,557 | 7,502 | 12,397 | 14,232 | 17,157 | 33 |

Operating Cash Flow | 4,165 | 6,386 | 7,868 | 10,390 | 13,708 | 35 |

ROCE(%) | 27.95 | 29.85 | 31.34 | 31.18 | 29.57 | 30 |

ROE(%) | 23.57 | 25.88 | 26.85 | 28.14 | 26.12 | 26 |

How Satyam Manipulated Its Financials

The fraud, which lasted for nearly a decade, involved multiple layers of financial manipulation:

Satyam's financial performance appeared stellar on paper. The company consistently reported double-digit revenue growth, with revenues exceeding $2 billion in 2008. Its stock price soared, making it a darling of investors. However, beneath the surface of this apparent success lay a web of deceit.

The company's financial statements painted a picture of robust financial health, but these numbers were largely fabricated. The fraud, orchestrated by Ramalinga Raju and his associates, involved inflating revenues, understating liabilities, and overstating cash reserves.

Fabricated Parts of Balance Sheet & Income Statement of Satyam Computers (FY 2009)

Particulars | Actual Financials (in Rs. Cr) | Reported Financials (in Rs. Cr)

| Difference (in Rs. Cr) |

Cash and Bank Balances | 321 | 5,361 | 5,040 |

Accrued Interest on bank FDs | - | 376 | 376 |

Understated Liability | 1,230 | - | 1,230 |

Overstated Debtors | 2,161 | 2,651 | 490 |

Revenue (FY2009) | 2,112 | 2,700 | 588 |

Net Profits (FY 2009 | 61 | 649 | 588 |

The Downfall: How the Scam Was Exposed

The fraud unraveled in January 2009 when Ramalinga Raju himself confessed to the manipulation in a letter to the board of directors. His confession came after a failed attempt to acquire Maytas Infrastructure, a real estate company owned by his family, which raised red flags among investors and regulators.

Key moments leading to the exposure:

The World Bank blacklisted Satyam in 2008 for presenting improper advantages (undisclosed incentive that is bribery) to its personnel. In December 2008, the World Bank imposed an 8-year ban on Satyam Computer Services, mentioning the provision of "wrong benefits" to Bank group of workers and inadequate documentation assisting fees charged for subcontractors.

Institutional investors began questioning discrepancies in financial reporting.

Regulatory scrutiny intensified, forcing Raju to come clean before the fraud was detected externally.

According to the Central Bureau of Investigation (CBI), the Satyam scandal traces its origins back to 1999 when the company embarked on an ambitious plan to accelerate its annual growth. The primary strategy employed was the manipulation of financial statements. This manipulation served two key purposes. First, it was aimed at maintaining a high share price on the stock exchanges where Satyam was listed. A robust share price was not only a reflection of the company’s financial health but also a tool to bolster investor confidence. Second, Ramalinga Raju, the chairman, sought to enhance the company’s market capitalization to attract more investors.

This strategy appeared to work, as Satyam was frequently lauded for its impressive growth and corporate governance. However, the truth behind this façade was revealed in 2009 when Raju admitted to manipulating financial accounts to the tune of $1.47 billion. He confessed that the fraud began as a minor discrepancy between the company’s actual operating profit and the figures reported in its books. Over time, this gap widened, leading to the creation of fictitious clients, projects, and invoices to artificially inflate the company’s financial performance.

The Role of Auditors and Promoters

The scandal also implicated Satyam’s auditors, PricewaterhouseCoopers (PwC), who did not hit upon the fraud despite auditing the organization’s debts for years. PwC later discovered that it had trusted falsified economic statements supplied with the aid of Satyam’s control. The auditors’ loss of diligence become stunning, as they not noted crucial purple flags, which includes:

- Fabricated customer identities.

- Fake invoices are used to inflate earnings.

- Falsified board resolutions and unauthorized loans.

The promoters of Satyam performed an enormous role in the fraud. A considerable part of the budget raised by using the business enterprise was diverted to buy land, taking advantage of the booming real estate marketplace. These lands have been managed by way of Raju’s family-owned companies, Maytas Properties and Maytas Infrastructure. This diversion of budget left Satyam with inadequate cash to fulfill its operational requirements, pushing the organization closer to inevitable fall apart.

The IT Department’s Involvement

Satyam’s IT department also played a minor but critical role in the fraud. The company’s software developers and system administrators created fake invoices and bills using advanced software programs. Financial data was stored in two different Internet Protocol (IP) addresses, further complicating the detection of fraudulent activities. The IT team’s involvement highlights how technology can be misused to perpetrate large-scale financial fraud.

The Aftermath and Investigations

Following Raju’s confession, the Indian government took control of Satyam and initiated investigations. The Serious Fraud Investigation Office (SFIO) revealed that Satyam had paid ₹186.91 crore in taxes over 7 years for fictitious fixed deposit accounts created by top executives to siphon money from the company. The fraud was a complex web of deceit involving multiple stakeholders, including promoters, auditors, and IT personnel.

The fallout from the scandal was immediate and severe. The Indian government stepped in to stabilize the situation, dissolving Satyam's board and appointing a new one. The company's clients and employees were left in limbo, with many fearing the worst.

In April 2009, Tech Mahindra, a subsidiary of the Mahindra Group, won the bid to acquire Satyam. The acquisition was seen as a lifeline for the beleaguered company. Tech Mahindra paid $351 million for a 31% stake in Satyam and later increased its ownership to 42.7%. The merged entity was renamed Mahindra Satyam.

Implications from the Satyam Scandal

The Satyam scandal serves as a cautionary tale for the company international, highlighting the significance of:

1. Ethical Leadership: The function of promoters and top executives in preserving integrity can't be overstated.

2. Financial Due Diligence: In terms of Auditors must exercise due diligence and not rely entirely on management-supplied information.

3. Regulatory Oversight: In order to achieve Strong regulatory frameworks are vital to prevent and detect financial fraud.

4. Whistleblower Mechanisms: Effective channels for reporting unethical practices are critical for early detection of fraud.

Regulatory Reforms and Corporate Governance

The Satyam scandal exposed glaring gaps in India’s regulatory and corporate governance framework. In response, several reforms were implemented:

SEBI introduced stricter norms for the companies, including enhanced disclosure requirements and stricter penalties for non-compliance.

The Corporate Governance Voluntary Guidelines (2009) were introduced to encourage companies to adopt best practices voluntarily.

Companies Act, 2013:

The new Companies Act introduced several provisions to improve corporate governance, such as:

Mandatory rotation of auditors every 10 years to prevent conflicts of interest.

Establishment of the National Financial Reporting Authority (NFRA) to oversee auditing standards and practices.

Enhanced responsibilities for independent directors to ensure accountability.

The Companies Act, 2013, also included provisions to protect whistleblowers, encouraging employees to report unethical practices without fear of retaliation.

Legal Repercussions of the case

The Satyam scandal led to significant legal consequences, shaping corporate governance regulations in India. Founder B. Ramalinga Raju, along with key executives, was arrested in 2009 and later sentenced to seven years in prison in 2015 for fraud, forgery, and breach of trust.

SEBI imposed a hefty ₹1,849 crore fine on Raju and others for insider trading and financial misrepresentation. Auditors from PricewaterhouseCoopers (PwC), which failed to detect the accounting fraud, faced a two-year ban from SEBI, and PwC was later fined $6 million by the U.S. SEC for its role in the scam. The fallout led to major regulatory reforms, including stricter disclosure norms, independent director mandates, and the creation of the National Financial Reporting Authority (NFRA) to improve audit oversight.

Conclusion

The Satyam scam remains a landmark case in India’s corporate history, serving as a reminder that even the most successful companies can collapse due to fraudulent practices. While governance standards have improved since then, recent financial frauds prove that the fight against corporate fraud is far from over. Stronger compliance, better transparency, and active investor awareness are crucial to prevent future financial scams and safeguard India’s corporate integrity. The case highlighted the need for ethical leadership and the visible risks of prioritizing short-term gains over long-term sustainability.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.